You’ve honed your skills, perfected what you make, you’ve made one for every family member and his dog and you have boxes of ‘bits’ everywhere.

So what do you do next? Now is the perfect time to turn your hobby into a business, let what you love to do earn you some money. What ever you do, don’t quit your day job yet! Turning your hobby into your business will not make you a millionaire over night, even those amazing success stories where they went from selling at small fairs to being stocked by Waitrose took blood, sweat and tears.

This guide will give you the basics of what you need to consider if you want to make the leap, in no particular order but I do advise that you do everything listed. That way you have the basics covered and you won’t be on the back foot if something comes up along your path to becoming a millionaire.

Just to make you aware before we begin, this information is for UK businesses; I am only giving you my personal experience with starting my own business, I am not legally trained at all.

Get Registered

When you decide that you want to start selling product you are now considered to be self-employed according to UK tax laws, irrespective of whether you already have an employed job. You will need to register with the HMRC for Self-Assessment, this means that you will report your income and expenditure in April and they will work out what tax you owe (if any).

The gov.uk website has a wealth of information on starting a business, you can quickly register for Self-Assessment as well as view your personal tax information.

The HMRC requires you to submit a tax return if you make over £1000 in turnover, many people will tell you that you don’t need to bother if you don’t expect to make that much however it is a good habit to get into. You just never know what will happen in your first year. It is best practice to keep a record of your income/expenses from April 6th to April 5th which is the standard tax year for all businesses. You can start your business at any time but when recording your income and expenses just go from the day you start to the following April, then start again a fresh.

That leads me nicely onto…

Keep Records

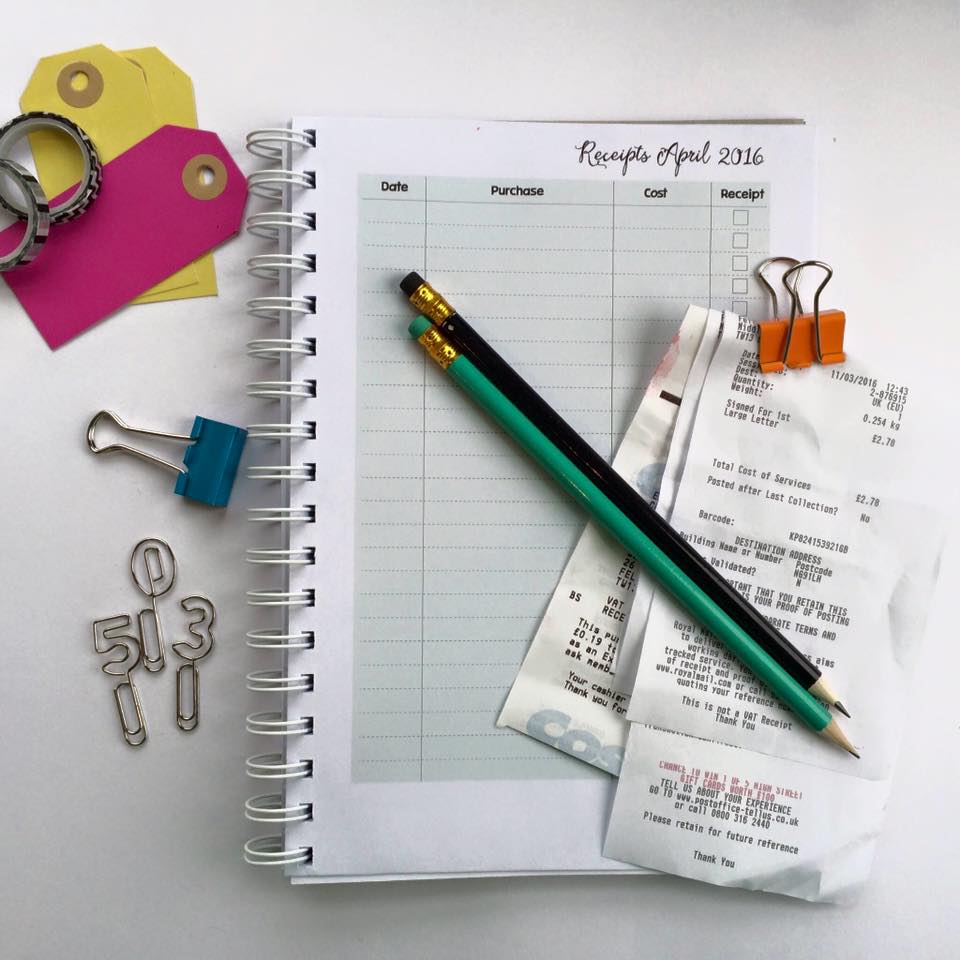

This is one thing I cannot stress enough, keep records! Keep track of your income and expenses! Not only will this give you an idea as to whether or not your hobby is making you any money but it will help you sooooooooo much when it comes to doing your tax return.

There are some fab small businesses that produce lovely income/expenses books and matching order books, when I first started I bought mine from the amazing Doris and Fred who do a fab book which has envelopes for each month for you to keep your receipts in. It also has a running total at the back so you know exactly where you are each month and whether you are making any money.

Another option to keep track of your income/expenses is using online accounting software such as Quickbooks or Xero. They connect to your bank account and you mark off your payment (called reconciliation, by clever accountant types). Both of these usually have a monthly subscription, although there are some free ones about, so this might be something to consider as your business gets bigger or busier.

You can also hire a bookkeeper, a quick google search for bookkeepers in your local area will turn up quite a few.

Choosing a Business Name

This is one of those tasks which either take minutes or weeks (there never appears to be an in-between). A name may just come to you or you may procrastinate over it for weeks! Once you have chosen a name there are a few things you need to check. You can’t expect to start up a supermarket named Tresco and not expect some backlash from an already very established brand.

First off, Google it and see what comes up, could it already be the name of a well-known business, is it someone who makes the same thing as you already? Don’t forget to also check if the business name is available on Facebook / Twitter / Pinterest / Instagram or any other social media or selling platforms you want to use (more about selling platforms later).

Next up check if the domain name (website address, the bit after the www) is available, this might be obvious when you do the google search but try out your name with a .co.uk or .com after it and see what comes up. You don’t really want to register the .co.uk to find the .com is a porn site! There are lots of companies with whom you can register a domain name, the one I use is Reg-123, they are a UK based company with excellent customer service (well in my opinion anyway).

Next check Companies House to see if there are any Limited companies set up with your chosen name, whilst there are no rules set up to stop you using the same name it could cause problems later down the line if your business expands. Technically as a sole trader you are ‘Trading as’ the name of your business.

Lastly it is a good idea to check whether the name is trademarked, this means the name is legally registered and you cannot use it without the written permission of the owner. You can certainly contact the owner of the trademark and ask if you can used it but it will probably be quicker and easier to just think of something else. You can check trademark registrations on the Gov.uk website – https://www.gov.uk/search-for-trademark

Insurance/Licences

When I moved out and when I got my first car the one thing my Dad made sure I had Insurance (obviously), but as well as insurance he always made me make sure I had legal protection. This is the same for your business. As morbid and terrible it is to think of, imagine if your product was the direct cause of injury to someone and they sued you?

If you’re planning on selling your products at fairs, then you will have to have public liability insurance. You should also let your home insurance company know that you are now running a business out of your home.

Although not legally required it is it just good practice and something that should be a natural part of setting up a business. There are lots of different companies who offer insurance although your choice of hobby might mean you need more specialist insurance so it’s good to shop around, maybe contact companies who make similar things to you and see who they have their insurance with.

As well as insurance you may need to have specific licences such as a food safety certificate if you are making cakes, or a CE Mark if you are making toys or things that children might use. I don’t have a lot of experience in these areas as my own craft does not require any additional licences but there are lots of resources on Google – just make sure you are looking at UK sites. The rules in the UK and the USA are very different.

Legal Stuff

There are certain things you must do to make sure you stay on the right side of the law when it comes to making the leap from having a hobby and running a business. If your items are being sold for less than £42 then they are not required but, as mentioned previously, it is a good idea to start on the right foot and get the ground work in place.

You should make sure your business address is visible on any platform that you use to sell with, including Facebook. If a customer has a problem then they need to be able to contact you, it also means that people know you are a legitimate business. Think about businesses that you would buy from and why you are confident placing an order with them.

You need to make sure you have a clear cancellation policy, you don’t want to get into a situation where people are cancelling orders once you have ordered your materials. You also need to have a clear returns policy, under distance selling rules people can return items they don’t want provided they are not personalised or cannot be returned for hygiene reasons.

For more information on distance selling rules and your responsibilities when selling online see the gov.uk website here.

It is a good idea to get a set of Terms and Conditions written up to cover yourself and your customers, it should outline what happens when an order is placed, what your returns policy is and what customers can do if they are not happy. If you are planning on collecting and keeping information such as people’s email addresses, then you will also need a Privacy Policy. There are lots of places online where you can get both of these documents such as legal sites, I have all of mine written for me by another small business called Virtual Bird.

Pricing

Now this is a fun one! One thing I have learnt over the years that I have been selling handmade items and talking with other small businesses whose turned their hobby into a business is that pretty much every small business prices their products TOO LOW!! It drives me absolutely potty!

Ask yourself this; do you love what you do? Do you invest in good quality materials? Do you make a quality product? Do you value your time?

If you’ve answered yes to all these questions, then you deserve to be PAID for these things!

When pricing up your pieces you need to take into consideration 3 things:

- The cost of your materials

- The time it takes you to make the piece

- The cost of your skill

Most people are good with number 1, that’s pretty easy! Number 2, a little harder to work out but if you’re not paying yourself AT LEAST minimum wage then why exactly are you starting your own business? You might as well go and work at Tesco. It’s number 3 that people struggle with. Most people say that they are just starting out so they can’t charge too much – why??? You have got to a point where what you make is good enough to sell so charge what it and YOU are worth. In all honesty if a product is too cheap I won’t buy it as I expect it will be cheaply made and fall apart or that the seller isn’t putting much effort in to make it.

If I want quality I will shop in somewhere like Waitrose, Next, Monsoon, if I want cheap and cheerful then I will go to the local pound shop. Believe me I know this is super scary, this is a lonely game and there are business out there with thousands of Facebook likes and massive Instagram followers making the same as you but if you price your pieces cheap all you are doing is saying you are not as good as them – and you ARE!

If you’re stuck on what prices to charge for your items then check out your competitors, or businesses that have inspired you, see what they are charging. Also there is a fab tool called the Craft Calculator available here or as an app you can download. Have a play about with the profit mark-up to see how much profit you can make to match up with prices other people are charging. Remember at the end of the day you are selling a handmade, unique, one of a kind product and that, in itself, has its own price.

You’ve got your products, your business name, you’ve set up your social media accounts, you’ve worked out your pricing… Now the fun begins! If you’ve found this blog useful please feel free to share it with friends and if you’ve turned your hobby into a business then let me know in the comments below.

Check out our next blog post on where you can sell your gorgeous items.

Author: Emma Hannay, owner of Stamped With Love

Emma has been running her business since 2015 and has come from a sales background. She creates beautiful hand stamped jewellery, keyrings and keepsakes from her home in Havant, Hampshire. They are all lovingly personalised with your own text and are available at stampedwithlove.uk